Table of Content

Readers having legal or tax questions are urged to obtain advice from their professional legal or tax advisors. While the aforementioned information has been collected from a variety of sources deemed reliable, it is not guaranteed and should be independently verified. Bankrate’s goal is to help readers maximize their money and navigate life’s financial journey.

They can also show whether houses are moving quickly off the market or taking a while to sell. Colorado homes sold for 20.8% less than the asking price in October 2022, a 28.0 percent decrease from the previous year. Only 43.2% of properties saw price decreases, which is an increase from the 19.0% of homes in October of last year. The sale-to-list price was 98.4%, down 2.6 points from the previous year. Colorado had 27,921 properties for sale in October 2022, an increase of 6.3% from the previous year. 7,493 new residences were listed, which is a 28.9% decrease from the previous year.

What You Should Know About Buying a Home in California

In a period of rising or volatile interest rateslike the current oneit may be wise to lock in a rate that seems affordable for you. After a month of declines, mortgage applications ticked up last week as buyers looked to take advantage of several weeks of slightly lower rates, according to the Mortgage Bankers Association. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there.

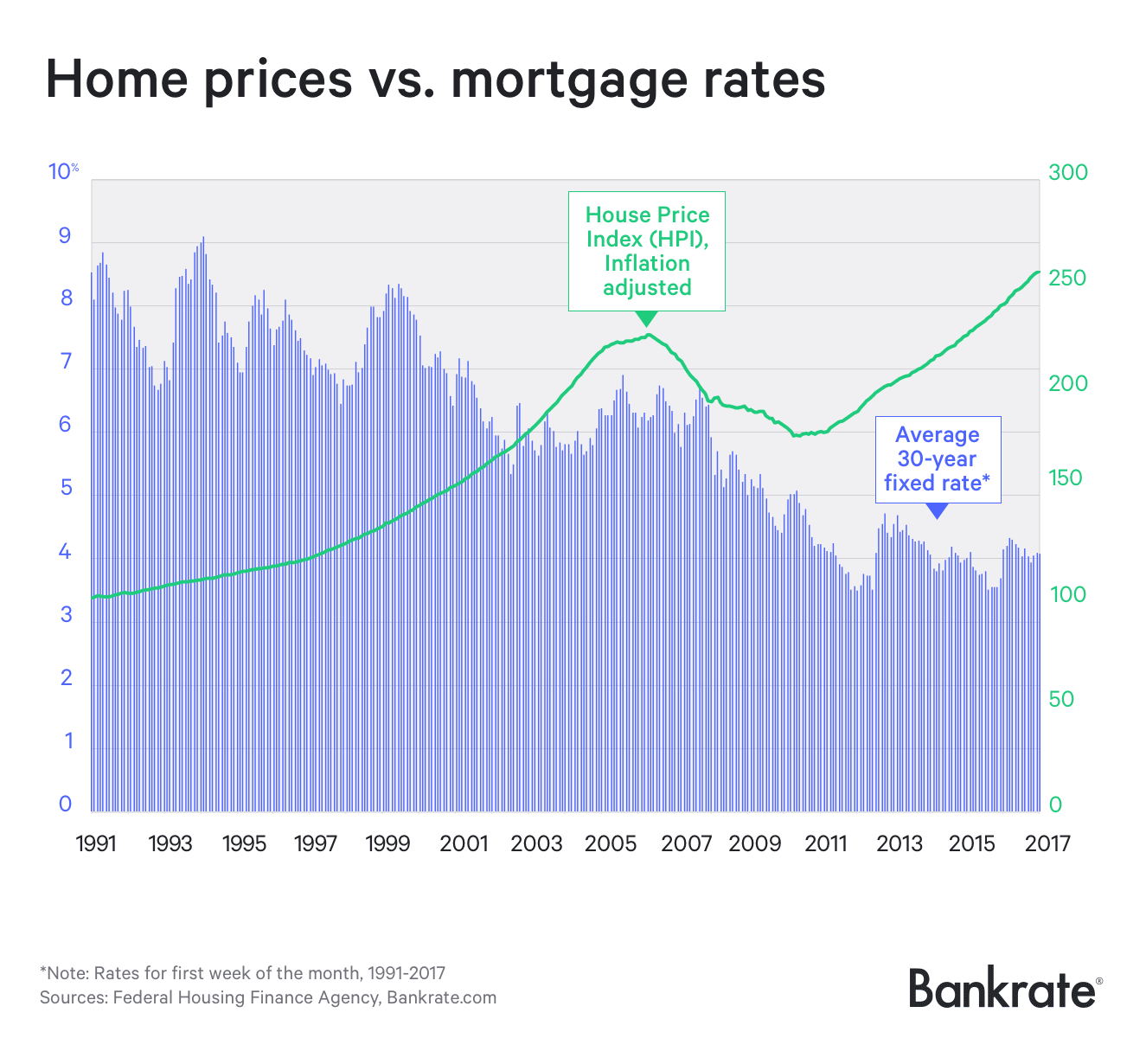

If you have specific questions about the nuances of applying for a mortgage, refinancing or buying a home in California, a mortgage banker or realtor licensed to work in the state can be a great asset. Calexico, CA — Living in Calexico is slightly more expensive than the other cities on this list, but is still well below the cost of living in the rest of the state. Barstow, CA — Barstow, which is halfway between Los Angeles and Vegas, is a small California town with an affordable cost of living. The median value of a home in Barstow is only $107,100 and the median monthly cost of ownership is $1,116. All fixed-rate loan products followed the same trend upward and then downward trend as the 30-year fixed-rate loans.

Home Equity Loans And Helocs In California

That means that more California mortgages are "jumbo loans," which are any that exceed the conforming loan limit. This limit is $647,200 in most U.S. counties, though as mentioned above, several California counties have higher conforming loan limits in recognition of the high real estate prices in those areas. If you plan on getting a jumbo loan for your home mortgage, brace yourself for paying a higher interest rate.

This table does not include all companies or all available products. By starting it online or by meeting with a mortgage loan officer. Our local mortgage loan officers understand the specifics of the California market. Let us help you navigate the mortgage process so you can focus on finding your dream home.

Year Fixed Mortgage Rates in California

To set yourself up for success and help you figure out how much you can afford, get pre-qualified by a licensed California lender before you start your home search. Also check California rates daily before acquiring a loan to ensure you’re getting the lowest possible rate. Mortgage and refinances from top partners that are well below the national average. The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear.

Your individual rate will vary depending on your location, lender and financial details. As a homebuyer, you are in the drivers seat to a certain degree. How youve handled money in the past is a big factor in how much house you can afford and what your monthly payment will be.

When Is The Best Time To Refinance To Get A Lower Rate

Its important to know that the mortgage industry does offer a wide variety of resources that are aimed at protecting the consumer. The three main organizations are the Consumer Financial Protection Bureau , the California Department of Real Estate and the Nationwide Mortgage Licensing System . Mortgage rates have surged since the start of 2022, which reflects investors views that the economy is too hot and that the Federal Reserve will take any necessary steps to cool it down and rein in inflation.

You can easily view our refinance rates by using our iPhone Mortgage Rates App. The rates of Home Equity Loans and Home Equity Lines of Credit in California are usually higher than general home purchase or refinance rates. However, they can help you achieve more financial flexibility.

If you’re hoping to buy a home in California, you’ll need to research the best mortgage rates statewide. Shopping around with multiple mortgage lenders will increase your chances of landing a great deal and a lower monthly payment on your loan for what could be many years. Estimated monthly payment and APR calculation are based on a down payment of 0% and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable.

You agree that any such advice and content is provided for information, education, and entertainment purposes only, and does not constitute legal, financial, tax planning, medical, or other advice from Interest.com. You agree that Interest.com is not liable for any advice provided by third parties. To use some of the Services, you may need to provide information such as credit card numbers, bank account numbers, and other sensitive financial information, to third parties.

No comments:

Post a Comment